Title Agents Errors and Omissions Insurance - Riebling Insurance Agency

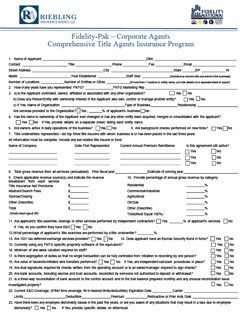

Fidelity-Pak Title Agents Errors and Omissions Insurance

As a title agent, title examiner, notary public, attorney, abstractor, escrow/closing agent, and others, it is important that you provide error-free results. In fact, your clients downright depend on it. However, sometimes payoff amounts or closing costs can be miscalculated as a result of various factors, including attempting to crunch the numbers on your own, as opposed to obtaining the correct amount from the proper agency.

When this occurs, an existing loan may not be satisfied, which leaves your clients liable for the remaining amount. Title agent errors not only put your clients at a financial loss, but it also leaves you susceptible to a lawsuit. Title Agents Errors and Omissions Insurance protects the title agency's financial security against the impact of a lawsuit as a result of title agents error and omissions.

What is Title Agents Errors and Omissions Insurance (Title Agents E&O)?

Title Agents E&O insurance provides protection against losses suffered as a result of an emerging lawsuit claiming alleged errors in the title documentation process. This includes escrowing and searching. The insured is provided indemnification in the event of final settlement, up to the policy limit, as well as payment for defense costs.

Title Agents E&O insurance differs from Commercial General Liability, in that Commercial General Liability insurance does not provide coverage for performance disputes, errors, and any other liability issues.

Title Agents Errors and Omissions Insurance Under the Fidelity-Pak Program

Title Agents E&O under the Fidelity-Pak Program provides a wide range of comprehensive E&O coverage for insureds who perform professional services for a fee, including:

When this occurs, an existing loan may not be satisfied, which leaves your clients liable for the remaining amount. Title agent errors not only put your clients at a financial loss, but it also leaves you susceptible to a lawsuit. Title Agents Errors and Omissions Insurance protects the title agency's financial security against the impact of a lawsuit as a result of title agents error and omissions.

What is Title Agents Errors and Omissions Insurance (Title Agents E&O)?

Title Agents E&O insurance provides protection against losses suffered as a result of an emerging lawsuit claiming alleged errors in the title documentation process. This includes escrowing and searching. The insured is provided indemnification in the event of final settlement, up to the policy limit, as well as payment for defense costs.

Title Agents E&O insurance differs from Commercial General Liability, in that Commercial General Liability insurance does not provide coverage for performance disputes, errors, and any other liability issues.

Title Agents Errors and Omissions Insurance Under the Fidelity-Pak Program

Title Agents E&O under the Fidelity-Pak Program provides a wide range of comprehensive E&O coverage for insureds who perform professional services for a fee, including:

- Escrow Agent

- Title Insurance Agent

- Title Searcher

- Title Abstractor

- Closing Agent

- Notary Public

- CFPB Coverage - This coverage assists with expenses incurred as a result of Consumer Financial Protection Bureau Matters. Under this coverage, Insureds receive up to $150,000 sub-limit coverage for applicable attorneys' costs, fees, and expenses, including hearing, subpoena, civil investigation, or civil action received or conducted by the CFPB.

- Prior Acts Coverage - This coverage provides protection against all claims caused by wrongful acts following the retroactive date and before the end of the policy period.

- Claims Related to Defect or Deficiency - This coverage provides protection against claims related to a deficiency or defect not recorded in the public records.

- Claims Caused by Independent Contractors - Under this coverage, Insureds are provided protection against claims caused by independent contractors.

- Fraudulent Email Wire Transfer Coverage (THIRD PARTY) - Under this coverage, compensation is paid on behalf of the Insured, those sums insured become legally obligated to pay up to $1m for a covered loss as a result of an employee transferring escrow funds from an account of the insured in dependence upon fraudulent email instructions received from a criminal claiming to be a lawful party to the transaction.

Why You Need Title Agents Errors and Omissions Insurance

Sometimes, a claim or lawsuit may not occur as a result of an error or omission on the part of the title agent, escrow agent, or abstractor.

For example, if there is a title hazard on a property, the title agent may feel they are not responsible because the claim isn't covered; however, the title agent is likely to be named in the lawsuit of the policyholder against the insurer.

For example, if there is a title hazard on a property, the title agent may feel they are not responsible because the claim isn't covered; however, the title agent is likely to be named in the lawsuit of the policyholder against the insurer.

Title Agents E&O insurance helps protect your business against baseless claims by covering any judgments resulting against you, as well as legal defense costs, including court costs, up to the coverage limits on your policy. In addition, it also protects against legitimate claims in the event you or a staff member makes a mistake.

The title industry plays a crucial role in protecting one of the most important investments your clients will make in their lives by providing a means for the secure transfer of their real estate in the industry. Likewise, Title Agents E&O insurance also helps secure escrow agents, abstractors, and attorney's ability to earn a living, while also protecting title insurance company's most valuable investment, their business.

The title industry plays a crucial role in protecting one of the most important investments your clients will make in their lives by providing a means for the secure transfer of their real estate in the industry. Likewise, Title Agents E&O insurance also helps secure escrow agents, abstractors, and attorney's ability to earn a living, while also protecting title insurance company's most valuable investment, their business.

Contact Us for More Information on Title Agents Errors and Omissions Insurance

We have been providing specialized commercial insurance for businesses of all sizes for more than a generation. We provide protection beyond insurance policies. We also insure routine business transactions, which is constantly under threat from hackers, sometimes from other countries, which makes it harder to capture and prosecute. We can protect you from these types of financial losses and more.

Please contact us today for more information on Title Agents Errors and Omissions Insurance.

Please contact us today for more information on Title Agents Errors and Omissions Insurance.