Customer Information Theft Insurance - Riebling Insurance Agency

Insurance for Theft of Customer Personal Financial Information

Outside of companies employing the proper procedures to make sure their customers' privacy and security are protected, companies can also implement their own safeguards, such as insurance for theft of customer financial information, to protect their own situation.

In today's computer age, it is becoming increasingly easier to breach company's systems and gain access to sensitive customer information, which can lead to identify theft, and more, and your company as the subject of a lawsuit, which can be costly for your company, especially if you are required to pay damages. However, customer personal financial information insurance helps protect your company from out-of-pocket costs as a result of unfavorable court decisions due to a customer privacy breach.

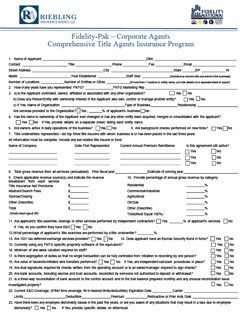

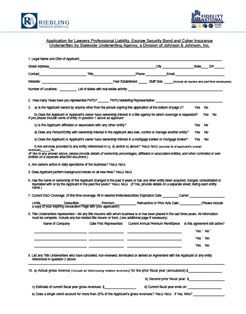

The Fidelity-Pak Insurance Program

provides various types of insurance coverage that is designed to offer protection against the day to day risks affecting the title industry, and more, including fraudulent wire transfer insurance and cyber liability insurance, which provides privacy and security liability coverage for injuries caused by a lawsuit filed against you due to a security or privacy breach.

The program also provides various levels of coverage for businesses of all sizes, which enables you to choose the right coverage for your company. For more information regarding the Fidelity-Pak Insurance Program, please contact us.

How to Comply with the Financial Privacy Rules

Various companies gather sensitive customer information, such as addresses, names, credit card information, bank account numbers, Social Security numbers, credit histories, and income, which in the wrong hands, can be damaging. Therefore, it is up to companies to ensure the privacy and security of sensitive customer information. In fact, according to the Financial Privacy Rule, companies must have procedures in place to help secure customer details.

The Gramm-Leach-Biley (GLB)Act, also known as the Financial Modernization Act of 1999, requires that all financial entities regulated by the Federal Trade Commission (FTC), including banks and insurance companies, have procedures in place to protect customer finances.

Under this Financial Privacy Rule, the FTC as well as other agencies who enforce the rule, regulate how companies can collect and share customer information. They also regulate the Safeguard Rule, which is another provision designed to hinder unlawful access to customer information, that requires all financial institutions to establish and maintain safeguards to protect sensitive customer data from being illegally accessed under false pretenses by companies or individuals.

These rules apply to businesses of all sizes that are significantly engaged in providing financial services or products, including mortgage brokers, nonbank lenders, real estate or personal property appraisers. Additionally, companies covered by the rule are also responsible for taking measures to make sure their service providers, as well as their associates, also protect customer data in their custody.

Under the Safeguard Rule, companies must write out a security information plan that details their initiative to protect customer data. This company plan must be relative to the company's essence and the extent of business as well as the size of the company and the quality of the customer data it collects.

According to the Financial Privacy Rules, a company's plan must:

- Assess the regulations of customer privacy for each applicable area of the company's dealings, and examine how effective the current safeguards are for managing these risks.

- Develop and apply a protection program and monitor it often to ensure it is effective.

- Appoint the proper employees to organize their information security plan.

- Delegate service providers that can sustain the proper safeguards as well as manage the handling of customer data.

- Assess and modify the plan so that it remains relevant to the situation, including changes in the outcomes of tests for security and supervision or changes in the company's dealings.

- Securing Consumer Information

The Safeguard Rule also requires companies to examine the risk to customer information in every area of their operation, including information systems, identifying and governing system failures, and employee management training, and then address these risks accordingly.

Some safeguards the FTC suggests companies could implement include:

- Check references as well as the background of employees before hiring employees who will be able to access customer information

- Continuously remind all employees of the company's policies as well as the legal requirements to keep customer information confidential and safe.

- When security policies are violated, impose disciplinary measures to correct it.

- When transmitting sensitive financial data, information contained on credit cards, be sure to use a secure connection, such as Secure Socket Layer (SSL) so that the information is secure while in transit.

- Utilize anti-spyware and anti-virus software that updates regularly.

- Maintain updated firewalls, especially when using internet connections that utilize broadband or when enabling your employees to access the company's network from off-site locations.

- Utilize updated security software to warn you of intrusions.

- Utilize screensavers that lock employees' computers after they have been inactive for a while so that no one can gain entry to the computer without a password.

- Caution customers against providing sensitive data, such as account numbers, via emails or pop-up messages that prompt them to do so.

- Alert customers if their personal data is at risk of identity theft or other related harm as a result of a serious breach.

- Notify law enforcement of any breach that may involve unlawful behavior or if there is proof that the infringement has caused identity theft and more.

Law enforcement action can be taken against companies that violate consumer's privacy rights or falsely misleads consumers by neglecting to sustain the protection of customer data, which has resulted in considerable harm. The FTC also enforces other federal laws regarding customer confidentiality and security.

Contact Us for a Customer Information Theft Insurance Consultation

The Fidelity-Pak Insurance Program provides various types of insurance coverage that is designed to offer protection against the day to day risks affecting the title industry, and more, including fraudulent wire transfer insurance

and cyber liability insurance, which provides privacy and security liability coverage for injuries caused by a lawsuit filed against you due to a security or privacy breach.

The program also provides various levels of coverage for businesses of all sizes, which enables you to choose the right coverage for your company

Please contact us

for a free consultation.