ALTA Best Practices - Riebling Insurance Agency

About the American Land Title Association

Regulators, investors, and consumers want to know detailed information about the service providers with whom they do business with; therefore, the American Land Title Association (ALTA) developed a set of best practices as a way to address their concerns.

What are ALTA's Best Practices?

ALTA's best practices are a set of policies and procedures that were developed by ALTA's Board of Governors, which include representatives of the underwriting community as well as the agent, that serve as a standard guideline that mortgage industry lenders, real estate settlement companies, and other ALTA members adhere to as part of their professionalism.

These best practices were developed to help safeguard lenders and consumers during mortgage and real estate closings, which helps ensure compliance procedures for an overall positive real estate settlement experience.

What are the Guidelines Under ALTA's Best Practices?

As of current, there are seven primary best practices set by ALTA, which include:

- Establish and Maintain Current Business Licenses

- Under ALTA's best practices, members are required to both establish and maintain up to date licenses as needed to participate in the business of settlement and insurance services.

- By requiring that members establish and maintain their current licenses to conduct business, it helps ensure the company remains compliant with the state.

- Adopt Standard Real Estate Settlement Policies and Procedures That Help Ensure Compliance With Consumer Financial Laws, Regarding the Settlement Process

- There are consumer financial laws at both the state and federal levels that govern the settlement process.

- By adopting appropriate procedures and policies and conducting ongoing employee training as required by ALTA, it helps ensure companies remain in compliance with both federal and state laws, while also meeting their contractual agreements.

- Adopt and Maintain Appropriate Written Controls and Procedures for Escrow Trust Accounts that Allow for Electronic Verification of Reconciliation

ALTA Services

ALTA's best practices require that members adopt and maintain appropriate written controls and procedures for escrow trust accounts that allow for electronic verification of reconciliation for the main purpose of helping companies meet legal and client requirements for protecting client's monies.

By incorporating these procedures, it enables companies to help decrease the risk of a loss of client funds because the strategies put in place are designed to increase accuracy.

- Adopt and Maintain Written Privacy and Information Security Program to Protect Non-Public Personal Information as Required by Law - Both federal and state laws demand that companies adopt and maintain a written information security program that details the strategies they utilize to protect Non-public Personal Information. Under this law, the procedures put in place by the company must be befitting to the extent and nature of the company's activities, the size of the company, and the sensitivity of the customer information they collect. Each time a company makes a change, such as a change in their business or operations, they are required to adjust their program accordingly.

- Adopt and Maintain Written Procedures for Resolving Customer Complaints - By incorporating and maintaining written procedures for resolving customer complaints, it enables companies to ensure that insubordinate practices or below quality services are not disregarded.

- Adopt and Maintain a Written Procedures, Regarding the Development of Policies, Delivery, and Reporting and Settlement - Adopting and maintaining appropriate procedures for the development of policies, the delivery, and the settlement of insurance policies helps ensure companies remain in compliance with contractual and legal requirements.

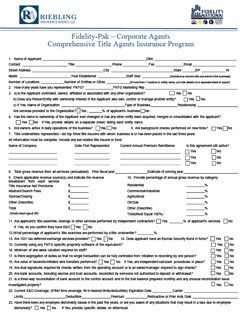

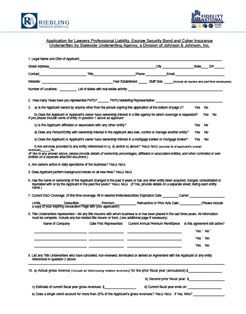

- Maintain Appropriate Professional Liability Insurance and Fidelity Coverage - Professional liability insurance, also called errors and omission insurance, help settlement companies and title agencies maintain the appropriate level of financial capacity to leverage their company services.

Additionally, many underwriting agreements and state laws require companies to maintain professional liability insurance, surety bonds, or fidelity insurance as part of their operation; therefore, by adhering to this best practice, it helps to keep companies in compliance.

How Can My Company Incorporate ALTA's Best Practices?

Though ALTA's best practices are not mandatory, a title company can choose to incorporate them on their own. The best place to start is by examining their own written guidelines. If the company finds that it already complies with the best practices, the next step is to simply adapt their own written procedures to reflect this and then put them in place to make it official.

Are There any Tools That Can Help Make it Easier to Incorporate These Best Practices?

The American Land Title Association offers a Best Practices Policy and Procedure Creation Guidance template that walks members step by step through the process of creating formal procedures and policies that are compliant with ALTA's best practices, which companies can use to draft their own written document.

Are the Best Practices Updated?

Best Practices are updated often. In fact, ALTA has a standing committee that regularly reviews the best practices and then updates them as needed.

What Happens if a Member of the Best Practices Violates the Standards?

Since adopting ALTA's Best Practices is not mandatory, it is left up to the agents, lenders, and underwriters to determine how violations will impact the company's underwriting policy.

Contact Riebling Insurance for More Information

At Riebling Insurance, we are committed to providing the resources you need to help keep your company growing and in compliance with state and local regulations as well as ALTA's Best Practices, including Professional Liability Insurance and Fidelity Coverage under our Fidelity-Pak Insurance program. We also remain up to date with changes in ALTA's Best Practices as well as state and federal laws in order to provide you with the most adequate insurance coverage available. This is especially crucial when you are facing court cases or matters involving the Consumer Financial Protection Bureau.

By participating in the Fidelity-Pak Insurance Program, you are not only taking valuable steps to help protect your company's own finances, but you are also sending the message to consumers and lenders that you value their funds as well and are willing to do what it takes to help protect it, which deems you as trustworthy.

Please Contact Us

today.