CFPB Regulatory Requirements - Riebling Insurance Agency

Fidelity-Pak Insurance for Owners and Companies In Violation of Consumer Financial Protection Bureau Regulations

The Consumer Financial Protection Bureau (CFPB) is a government regulatory agency that ensures that U.S financial institutions, such as lenders and banks, handle their customers fairly. Therefore, they have set forth a set of consumer financial laws for the financial industry that makes sure all consumers have access to markets for consumer financial services and products that are apparent, competitive, nondiscriminatory, and fair.

These laws are derived from sound research conducted by the CFPB along with input from the public, which includes consumer groups, advisory groups, industry groups, and small business review panels. Failure to comply with CFPB rules and regulations can result in enforcement actions taken by the Bureau, including:

- Warning Letters - The CFPB will often, first, send out a warning letter to alert financial institutions that they may have violated federal law, such as possible mortgage lending failures, participating in misleading mortgage advertisements, and more. Once you have received a warning letter from the CFPB, they advise your company to go back and review your company's business practices to make sure they are compliant with federal rules. Failure to do so could result in more drastic actions taken by the CFPB.

- Court Action - If the CFPB determines that you have violated a federal law, the Bureau may take any enforcement action against your company for the violation by either launching an administrative proceeding, which is conducted by an Administrative Law Judge who provides counsel as well as holds court hearings involving Administrative Law, or by filing an action in federal district court.

- Payments to Injured Consumers - When the CFPB or the court rules that a company has violated federal consumer financial law, it may order the person or entity to compensate the consumer for their injury. The Bureau also sometimes obtains payment as a penalty from people and entities that violated the law.

CFPB Regulatory Requirements

CFPB regulations run far and wide and are updated yearly; however, some of the most commonly enforced rules regarding the fair treatment of consumers include:

- Provide All Consumers with Equal Credit Opportunities - Under Consumer Financial Protection Bureau regulations, companies are forbidden to discriminate against an applicant on a restrictive basis regarding any aspect of credit proceedings. They are also not allowed to discourage consumers from obtaining or completing an application in any form, including orally, written, or in advertisements.

- Provide Notice to Consumers About Its Privacy Policies and Practices - Under CFPB regulations, financial institutions must inform consumers regarding their privacy policies and practices, including details concerning the circumstances for which they may share nonpublic personal information about its consumers with third parties who are not part of their company. Companies must also provide methods for their consumers to opt out of sharing their information with outside parties that are not affiliated with the company as part of the disclosure.

- Obtain Consumers Authorization When Initiating an Electric Funds Transfer - Under CFPB regulation, any persons performing an electronic fund transfer, including point-of-sales transfers, withdrawal of funds or direct deposits, debit transaction transfers, telephone transfers, and electronic funds using information from a check, are required to inform consumers that the transaction is to be processed as an electronic funds transfer. They must also receive permission from the consumer for each transfer. For point-of-sales transfers, the notification must be displayed in a clear view, and the person performing the electronic funds transfer must also provide the consumer with a similar notice during the transaction.

- Provide Accurate Customer Information - Under CFPB regulations, companies are required to provide accurate customer information to outside parties, including when sending customer information to credit reporting agencies. Companies also have an obligation to provide accurate mortgage loan reporting to outside parties.

- Inform Consumers of Fees Associated with Electronic Funds Transfers or Checks Returned Unpaid - If a fee for an electronic transfer or a returned check can be charged electronically as part of a point-of-sale transaction, the person performing the electronic fund transfer and who may be owed the fee must display the notification regarding the charge in clear view. The person must also present a similar copy of the notice to the consumer at the time of the transaction in addition to the amount of the fee as well as the factors that determine the amount.

- Practice Truth in Advertising - Under CFPB regulations, it is a violation for companies to intentionally hide or mislead consumers with falsified material, whether explicitly or implied in any commercial communication concerning any term of any mortgage credit product, including the fabrication of interest charges for the mortgage credit product, the yearly percentage rate, or any other rates, and the amount of any costs or fees to the consumer associated with the mortgage credit product, and more.

Contact Riebling Insurance for More Information

Sometimes due to no fault of their own, companies can find themselves in violation of CFPB regulations, which can result in costly payouts to consumers, and in some cases, even the CFPB itself. When this occurs, it can really cut into your company's bottom line if you are without the proper coverage to hedge against such risks.

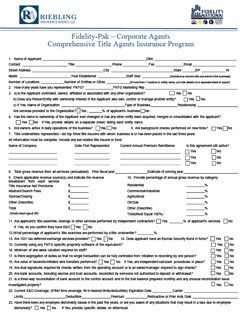

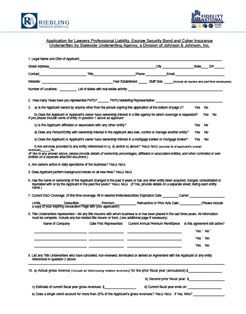

The Fidelity-Pak Insurance Program

offers various types of insurance coverage designed to protect companies against the everyday risks associated with conducting business, including Title Agents Errors and Omissions coverage, which helps safeguard against various causes of errors and omissions on the agent's behalf, including faulty software that results in misprinted consumer information. Under the Fidelity-Pak Insurance Program, you can also choose a coverage amount that's right for your particular business for added confidence.

Please contact us

for a free consultation.