Fraudulent Wire Transfer Insurance - Riebling Insurance Agency

Wire Transfer Fraud Coverage

What is Fraudulent Wire Transfer?

According to the FBI Internet Crime Center, fraudulent wire transfers present the most significant threat of theft and property damage to businesses.

In short, fraudulent wire transfer is a crime in which an individual uses a fraudulent scheme to coerce another individual or company to send money electronically to their account based on false representation or promises.

Many times wire fraud schemes rely on fraudulent emails, using a representative's name and email address that the person or business already knows. The hackers will usually target an executive of the company and then gain unauthorized access to their computer during which time they will gather useful information, such as customer and billing information. They will then use this data to create convincing email accounts that the customer or business recognizes and then quickly trick them into sending funds to a fraudulent account, resulting in a substantial loss of funds.

These emails are usually urgent in manner to encourage swift action. For instance, it may be sent during a time when a payment is due to prompt the person or company to submit the funds promptly. They may even be conversational in tone to gain their trust further. Because the person or business recognizes the company's name and email address, they will quickly submit a payment. However, upon closer inspection, the email address may read a bit differently than the real email address, such as Luxuryairlines.net instead of Luxuryairlines.com, signaling a red flag.

Quite often victims of fraudulent wire transfers are not even aware that they've been had until they try to confirm the funds' transfer with a manager. However, by then, the funds are already gone.

How Title Agents Can Be Exposed to Fraudulent Wire Transfer

The large funds moved between sellers, closing agents, and title companies make title companies a significant target for cybercriminals. The Federal Bureau of Investigations reports that the number of fraudulent wire transfer scams that occur to title companies has increased more than 400% from just two years ago as reported in all states.

Fraudulent wire transfers involving title companies typically occur during the closing transaction during which time cybercriminals target prospective home buyers as well as financial institutions.

The hackers will tap into the title company's computer and obtain their emails and customer data, searching for upcoming real estate closings. They then create authentic looking emails and then present themselves as the closing agent, attorney, escrow officer, or real estate agent, requesting that the buyer or financial institution make a wire transfer immediately to the fraudulent email address. They may even make a false claim, such as the wiring instructions or the closing process has changed, to prompt them to act.

Since the closing process can be a hurried one, the buyer or financial institution will usually comply with the request, resulting in a fraudulent wire transfer, only to be informed by the title company or closing agent later that they did not receive the transfer. However, as the title company, you can be held legally responsible for the loss due to the unsecured access to information from your company's computer.

Fraudulent wire transfers can also occur within your own company with your employees. For instance, an employee in the finance department could suddenly receive an email from the company's CFO requesting that they make an urgent wire transfer to cover a substantial cost, such as an acquisition cost. Because the email is from the CFO, the employee trusts it and complies with it. Later you find out the employee was scammed by a sophisticated email scheme, resulting in a significant financial loss.

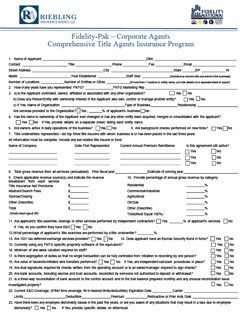

How The Fidelity-Pak Insurance Program Can Help Protect Businesses

Unfortunately, when it comes to fraudulent wire transfers, they are not going away any time soon, and since the criminals are often located overseas, it makes it more difficult for the government to catch them, which can leave both you and your customers vulnerable to financial loss. However, the Fidelity-Pak Insurance Program offers various ways to protect yourself, as well as your clients, against unlawful wire activities. It includes three levels of Fraudulent Wire Transfer Insurance coverage for maximum protection, which include:

- Fraudulent Email Wire Transfer Coverage (Third Party Coverage) - The Fraudulent Email Wire Transfer coverage for third parties compensates the insured up to $1 million for a loss that occurred from an employee wiring escrow funds from the insured's account as a result of relying on a dishonest email from a criminal posing as a credible party in the transfer.

- Fraudulent Email Wire Transfer Coverage (First Party Coverage) - The First Party Fraudulent Email Wire Transfer Insurance pays the insured up to $250,000 for a covered loss by an insured's employee who wired escrow funds from the insured's account due to their trust of fraudulent email wire instructions received by a bogus party claiming to be a legitimate part of the transaction.

- CFPB Coverage

- Consumer Financial Protection Bureau (CFPB) matters can rack up costly fees and expenses as a result of civil actions or hearings received by the CFPB. Our CFPB coverage pays the insured up to a $150,000 sub-limit for justifiable fees, costs, and expenses for CFPB situations, including civil action, hearing, subpoena, and civil investigation, involving the CFPB.

Reports show that wire fraud is responsible for more than $40 million in losses each year, which makes it one of the most significant types of fraud.

Contact Us for Wire Transfer Fraud Insurance

As digital use continues to rise and criminals continue to create even more sophisticated ways to commit wire transfer scams, it is becoming more critical than ever for businesses to protect their customers as well as their finances to help preserve their reputation. It is highly recommended that in addition to being on guard for red flags and taking the proper precautions to safeguard your customers' information, including installing the latest security software, you should also consider obtaining Fraudulent Wire Transfer Insurance to help cover and large losses that can potentially wipe you out.

Please contact us

today.